Addressing Alcohol Use Disorders through Taxation: A Public Health and Economic Win-Win in the time of COVID-19

“Taxes should be levied not with the idea of filling the public treasury at whatever cost to public morality and efficiency, but as method of reducing the consumption of alcohol”

---Raymond B. Fosdick and Albert L. Scott, Toward Liquor Control (1933)

For many of us who have experienced alcohol use disorders involving ourselves or family members, the remembrance of these events brings painful memories of behaviors that negate everything that we have done well, accomplished, or stand for; shattered dreams and aspirations; unintended damage to relationships with loved ones and friends; and feelings of guilt and frustration that the temptation to have “one more” cannot be controlled despite promises made of “never again.”

In some cultures, like the one that I grew up in, high tolerance of heavy alcohol use and binge drinking was not only accepted but expected of men and peer-reinforced, both as a rite of passage from adolescence to adulthood, and later in life as a sustained behavior. Common expressions, such as “por qué te vas, si todavía estás bien” (“why are you leaving the party if you are still sober”), clearly portray these deep-rooted social norms.

Some may identify this condition as a social deviance, an outlier of what is considered “good behavior.” But more than that, we need to be clear that alcohol abuse and dependency, with all their causes and manifestations, is a damaging “social disease” affecting not only the mental and physical well-being of individual people, but also the lives of others. Let’s elaborate on this topic.

The Nature of Alcohol Use Disorders

Alcohol use disorder (AUD), including alcoholism, is a chronic relapsing brain disorder, characterized by an impaired ability to stop or control alcohol use despite adverse social, occupational, or health consequences. The severity of the disorder is determined by specific symptoms, including problems controlling drinking, being preoccupied with alcohol, continuing to use alcohol even when it causes problems, having to drink more to get the same effect, binge drinking, or having withdrawal symptoms (e.g., trouble sleeping, shakiness, irritability, anxiety, depression, restlessness, nausea, or sweating) when a person rapidly decreases or stops drinking.

The impact of alcohol consumption on chronic and acute health outcomes in populations is largely determined by two separate but related dimensions of drinking: the total volume of alcohol consumed, and the pattern of drinking. Moderate alcohol consumption is up to 1 drink per day for women and up to 2 drinks per day for men. Patterns of drinking associated with AUD include:

- binge drinking, a pattern of drinking alcohol that brings blood alcohol concentration (BAC) to 0.08 percent (or 0.08 grams of alcohol per deciliter - or higher). For a typical adult, this pattern corresponds to consuming 5 or more drinks (male), or 4 or more drinks (female), in about 2 hours.

- heavy alcohol use as more than 4 drinks on any day for men or more than 3 drinks for women.

Alcohol Consumption

A study in The Lancet that analyzes trends in alcohol intake in 189 countries from 1990–2017 and estimates the rates through 2030, shows that between 1990 and 2017, global adult per-capita consumption (consumption in L of pure alcohol per adult [≥15 years]) in a given year) increased from 5.9 L to 6.5 L, and is predicted to reach 7.6 L by 2030. Globally, the prevalence of lifetime abstinence decreased from 46% in 1990 to 43% in 2017, albeit not a significant reduction, while the prevalence of current drinking increased from 45% in 1990 to 47% in 2017. The study forecast both trends to continue, with abstinence decreasing to 40% by 2030 (annualized 0·2% decrease) and the proportion of current drinkers increasing to 50% by 2030 (annualized 0·2% increase). In 2017, 20% of adults were heavy episodic drinkers (compared with 1990 when it was estimated at 18·5%), and this prevalence is expected to increase to 23% in 2030. Overall, men (70%) are more likely to drink than women (30%). The observed increase in alcohol use globally may be explained by increased purchasing power of consumers due to grow in per capita income, particularly in China and India.

Data compiled by Our World in Data, show that while alcohol consumption across North Africa and the Middle East is particularly low — in some countries, close to zero, alcohol use across Europe is highest at around 15 liters per person per year in the Czech Republic, Lithuania, and Moldova (equal to around two bottles of wine per person per week), and high in Germany, France, Portugal, Ireland, and Belgium – at around 12 to 14 liters. Outside of Europe, the only other country in this category of high per capita alcohol use is Nigeria.

When looking at consumption data within countries, it is observed that high-income people tend to drink more frequently. While those in lower income or educational status groups often drink less overall, they are more likely to have lower-frequency, higher-intensity drinking patterns.

Data on alcohol expenditure from North America, Europe, and Oceania show that it typically ranges from 0.5 percent up to 7.7 percent (in Ireland) of household expenditure.

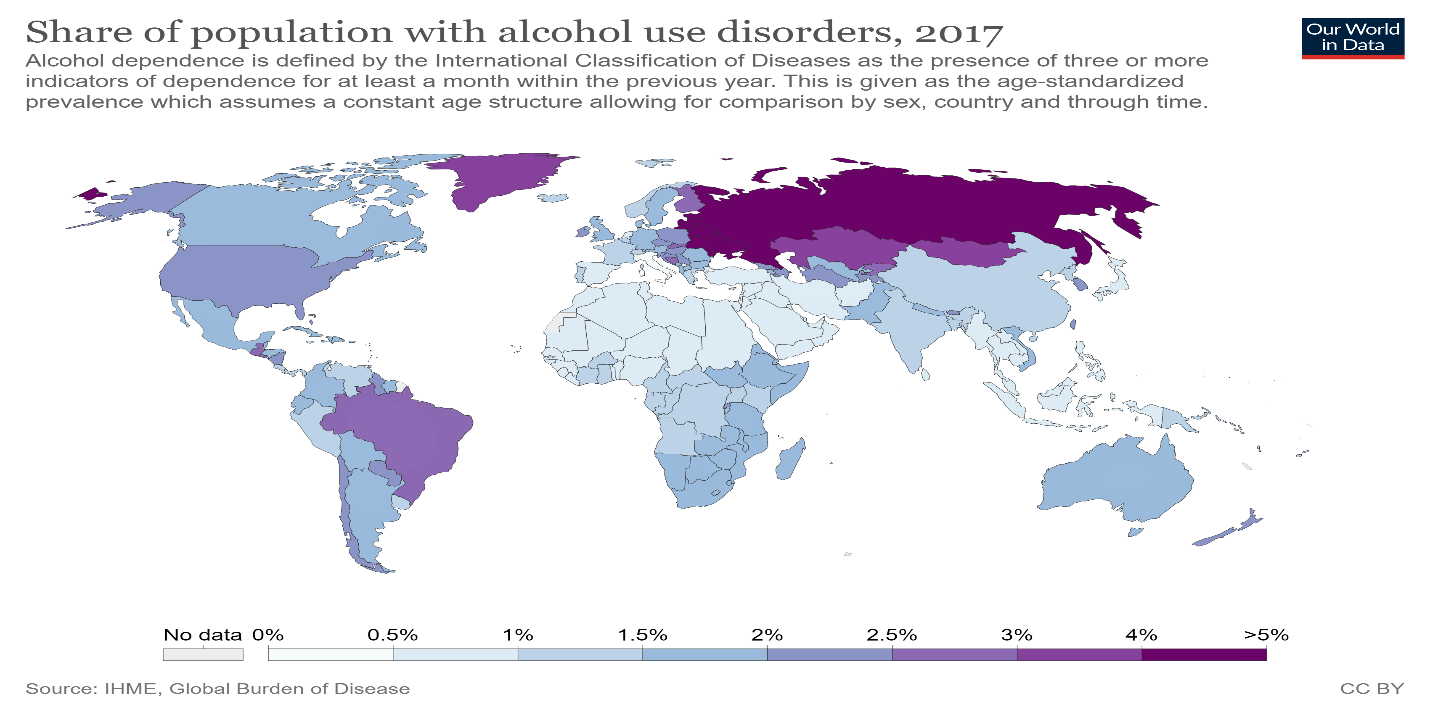

Globally, 107 million people or 1.8% of the total population are estimated to have an alcohol use disorder. The share of the population with alcohol use disorders across countries is shown in the map below, ranging from as low as 0.5 percent to almost 5 percent of the population.

Among youth, a study that reviewed alcohol consumption patterns and alcohol-related social and health issues among 15–29-year olds in Asian countries, found that in a majority of the selected countries, over 15% of total deaths among young men and 6% among young women are attributable to alcohol use. Alcohol use among young people was also found to be associated with a number of harms, including stress, violence, injuries, suicide, and sexual and other risky behaviors.

In Canada, approximately 80% of adults, aged 18 or older, consumed alcohol in the past year, with the proportion of the adult population with alcohol consumption rates above cancer guidelines ranging from 5% of adults in Toronto, Ontario to 15% of adults in Sherbrooke, Quebec (Canada’s Low-Risk Alcohol Drinking Guidelines for cancer recommends no more than 2 drinks per day for men and no more than 1 drink per day for women).

Mental health disorders are a major risk factor for developing alcohol dependency. The results of a study on mental health and alcohol use in developing countries showed that the consumption of alcohol is heavily gendered and is characterized by a high proportion of hazardous drinking among men. Hazardous drinkers not only consume large amounts of alcohol, but also do so in high-risk patterns, such as drinking alone and binging, which are associated with depressive and anxiety disorders as well as suicide and domestic violence. In the Americas, in countries such as Bolivia, Canada, Ecuador, Mexico, Peru, and the United States, indigenous peoples, who account for some 13% of the region’s population, suffer substantial alcohol use-induced conditions yet have limited access to care and other interventions.

Health Consequences

According to the World Health Organization (WHO), alcohol use is a risk factor in more than 200 disease and injury conditions. It is associated with the development of mental and behavioral disorders, including alcohol dependence, major noncommunicable diseases such as liver cirrhosis, some cancers, and cardiovascular diseases. A significant proportion of the disease burden attributable to alcohol consumption arises from unintentional and intentional injuries, including those due to traffic injuries, violence, and suicides, and fatal alcohol-related injuries tend to occur in relatively younger age groups. Also, there is a causal relationship between harmful drinking and incidence of infectious diseases such as tuberculosis as well as the incidence and course of HIV/AIDS. Alcohol consumption by an expectant mother may cause fetal alcohol syndrome and pre-term birth complications, impacting human capital development.

Worldwide, about 3 million deaths every year result from harmful use of alcohol, which represent 5.3 % of all deaths. More than three quarters of these deaths were among men. Overall, 5.1 % of the global burden of disease and injury is attributable to alcohol, as measured in disability-adjusted life years (DALYs), which reflect both mortality and morbidity.

WHO data for 2016 also show that of all deaths attributable to alcohol consumption worldwide, 28.7% were due to injuries, 21.3% due to digestive diseases, 19% due to cardiovascular diseases, 12.9% due to infectious diseases, and 12.6% due to cancers. Additionally, alcohol use was responsible for 7.2% of all premature deaths (among persons 69 years of age and younger), with younger people aged 20–39 years old disproportionately affected (13.5% of all deaths among this group are attributed to alcohol use).

The age-standardized alcohol-attributable burden of disease and injury globally was 38.8 deaths and 1758.8 DALYs per 100 000 people, with the highest burden in the WHO African Region (AFR) (70.6 deaths and 3044 DALYs per 100 000 people). This is in contrast to the level of alcohol consumption which was highest in WHO’s European Region (EUR). The alcohol-attributable burden of disease and injury in Africa was due, in part, to the large burden of disease caused by tuberculosis, cardiovascular diseases, digestive diseases, and injuries (to which alcohol is a contributing factor). This explains why Africa has the highest age-adjusted burden of disease and injury attributable to alcohol consumption. The age-standardized burden of disease and injury attributable to alcohol consumption was lowest in the Eastern Mediterranean Region (EMR) (7.0 deaths and 322 DALYs per 100 000 people). Data for the other regions are: Europe, 62.8 deaths and 2726.5 DALYs per 100 000 people; Americas, 34.1 deaths and 1821.9 DALYs per 100 000 people; South East Asia, 36.8 deaths and 1718.3 DALYs per 100 000 people; and Western Pacific, 24.3 deaths and 1132.9 DALYs per 100 000 people.

The proportions of all deaths and DALYs caused by alcohol consumption were highest in the European Region, where 10.1% of all deaths and 10.8% of all DALYs were attributable to alcohol consumption, and were lowest in the Eastern Mediterranean Region, where 0.7% of all deaths and 0.7% of all DALYs were attributable to alcohol consumption. Data for the other regions are: Africa, 5.1% of deaths and 4.1% of DALYs; Americas, 5.5% of deaths and 6.7% of DALYs; South East Asia, 4.6% of deaths and 4.6% of DALYs; and Western Pacific, 4.1% of deaths and 4.9% of DALYs.

Social Impact

Broader negative social impacts of alcohol use are reflected in the statistics for road traffic-related injuries and fatalities, violent crimes, and gender-based and sexual violence.

Drunk driving is an important risk factor for all road users, and young drivers aged 18–25 are particularly at risk of crashing. As blood alcohol concentration (BAC) increases, so does the likelihood of crashing, particularly above a BAC of 0.04 grams per deciliter (g/dl). WHO estimates that nearly 2 million people are killed on the world’s roads annually, with an additional 20-50 million people seriously injured. The share of all road traffic deaths attributed to alcohol consumption above the national legal limit for alcohol consumption was estimated in 2013 to vary from a high 57.5% in South Africa to a low of 3.8% in China. In 2014, alcohol-impaired driving fatalities accounted for 31% percent of total driving fatalities in the United States.

A recent World Bank Group report, “The High Toll of Traffic Injuries: Unacceptable and Preventable,” showed that besides preventing loss of life of people and the resulting pain and misery for families and communities, there are significant long-term economic gains to be achieved from the adoption of simple, sustainable, affordable, and effective traffic safety policies and interventions, including hiking up taxes to increase the price of alcohol products and regulating their marketing and selling practices. The estimated impact in an initial set of five countries (China, India, Philippines, Tanzania, and Thailand) ranged from a 7% to 22% increase in GDP per capita over 24 years – that could be achieved through substantial reduction in road traffic injuries and deaths in line with the target set under the UN’s Sustainable Development Goals 2030 Agenda. This finding sends a clear message to governments: there is a significant economic loss associated with every year of inaction when LMICs fail to adopt effective policies and interventions to substantially reduce road traffic injuries and deaths.

Research on the effects of alcohol abuse on families shows that alcohol abuse and addiction play a role in intimate partner violence, cause family financial problems, impair decision-making skills, and contribute to child neglect and abuse.

The share of all crimes which are considered to be alcohol-related, including both offenses in which the alcohol consumption is part of the crime such as driving with excess alcohol, liquor license violations, and drunkenness offenses, and all those crimes in which the consumption of alcohol is thought to have played a role of some kind in the commission of the offense (e.g., assault, criminal damage, and other public order offenses), is estimated to vary significantly: in some countries – including Iran, Chile, and Scandinavian countries – the share is well below 5%, while in the UK, it is over 50%.

Additional country evidence illustrates the wider social and impact of AUD. As documented back in the mid-2000s in the report “Dying Too Young,” alcohol abuse contributed significantly to the dramatic decrease in life expectancy among males and the shrinking of the total population experienced in Russia during first decades of the post-Soviet period (1990-2000).

Are people drinking more amidst the COVID-19 pandemic?

Alcohol misuse is already a public health concern in many countries, and it has the potential to further complicate the COVID-19 pandemic in multiple ways. Excessive alcohol consumption can influence COVID-19 susceptibility and severity, as it both activates the immune system, causing inflammation, and interferes with the body’s immune response to viral and bacterial infections. And, in a vicious cycle, the broad effects of the pandemic are also likely to lead to excessive alcohol consumption. As documented in a previous post, people are more likely to drink more as a coping mechanism "during times of uncertainty and duress", particularly in the face of raising unemployment and loss of income. The COVID-19 crisis is not an exception. For example, with bars and restaurants closed in the United States, sales of alcohol in the United States have spiked nearly 27% since the start of the pandemic, with consumers gravitating to larger pack sizes.

Also, COVID-19 stress due to lockdown and isolation has the potential to increase the risk of developing AUD and of relapses among people struggling to overcome this disorder. Studies have shown that there is a clear relationship between anxiety and AUD. Both prolonged drinking and alcohol withdrawal are associated with an increased incidence of anxiety; people with general anxiety and panic disorders often self-medicate their condition with alcohol; and people with anxiety who self-medicate with alcohol often develop AUD.

How to control this problem?

The most cost-effective policies or “best buys” to reduce alcohol use include increasing taxes on alcoholic beverages, enacting and enforcing bans or comprehensive restrictions on exposure to alcohol advertising across multiple types of media, and enacting and enforcing restrictions on the retail availability of alcohol.

Other effective interventions include the enactment and enforcement of drunk-driving laws and blood alcohol concentration limits via sobriety checkpoints. Indeed, the number of countries reporting the adoption of these measures increased substantially between 2008 and 2016: the majority (97) of countries studied by WHO have a maximum permissible blood alcohol concentration (BAC) limit to prevent drunk driving at or below 0.05%; 37 countries have a BAC limit of 0.08; and 31 countries have no BAC limits at all. Seventy countries (41%) reported using sobriety checkpoints and random breath-testing as prevention strategies, but 37 (22%) used neither strategy.

Taxing alcohol

As observed by Richard M. Bird, excise taxes on alcohol as well as on tobacco have long been a dependable and significant revenue source in many countries globally. In recent years, increased attention has been paid to the way in which such taxes may also be used to achieve public health objectives by reducing the consumption of products with adverse health and social impacts.

Alcohol taxation and pricing policies have public health and economic benefits: 1) control of alcohol consumption and public health problems caused by alcohol consumption, 2) prevention of drinking initiation, and 3) tax revenue generation.

Several types of alcohol excise taxation methods are employed around the world, including: uniform tax methods – such as specific taxation (where the tax is calculated based on the amount of ethanol a beverage contains), ad valorem taxation (where the tax is based on the price of the alcoholic beverage), and unitary taxation (where the tax is based on the volume of the alcoholic beverage) – and combination tax methods such as mixed specific and ad valorem taxation and ad valorem with specific floor taxation. These methods have different attributes that may be appropriate to different contexts and different alcohol control objectives. For example, specific taxation may be appropriate for high-income countries that have a high prevalence of drinkers since it promotes consumption of beverages with low alcohol content instead of beverages with high alcohol content, resulting in a reduction in total alcohol consumption. Ad valorem with specific floor taxation and mixed specific and ad valorem taxation may be appropriate for low- and middle-income countries since they promote consumption of medium alcohol content beverages, which are expected to reduce total alcohol consumption among heavy drinkers and prevent drinking initiation among young people. The government may also apply a minimum price measure to control problems caused by inexpensive alcoholic beverages.

Hiking tax rates to increase the price of alcoholic beverages is one of the most cost-effective and cost-saving approaches to reducing alcohol consumption and harm. As such, it is important to note that alcohol and tobacco taxation may differ with respect to their public health goals. While there is no safe level of smoking, in terms of alcohol consumption, the public health goal is moderation (except in the case of road safety, where no level of drunk driving is safe). Hence, the public health goal for taxing alcohol beverages is to limit the harm caused by alcohol consumption, either by reducing or preventing increases in the overall average consumption per person.

The WHO’s Global Strategy to Reduce the Harmful Use of Alcohol recommends that countries establish a system for specific domestic taxation which may take into account the alcohol content of the beverage. The strategy also encourages countries to review prices regularly in relation to inflation and income levels; to ban or restrict sales below cost and other price promotions; and to establish minimum prices for alcohol where applicable. According to the findings of the 2015 WHO Global Survey on Progress in Alcohol Policy, 59% of 164 reporting countries indicated that they had established or increased the excise tax on alcohol since 2010, covering 5 billion people.

The results of a study that compared the scale and distribution across society of health impacts arising from alternative alcohol tax and price policy options have shown that, compared to taxation based on product value, alcohol-content-based taxation or minimum unit pricing would lead to larger reductions in health inequalities across income groups. The study also estimated that alcohol-content-based taxation and minimum unit pricing would have the largest impact on harmful drinking, with minimal effects on those drinking in moderation.

While the excise tax rate is an important factor in determining the price of alcoholic beverages, an important variable to influence consumption, as is also the case in tobacco taxation, is the extent to which increases in excise taxes are passed along to consumers as opposed to being absorbed by firms, as people are sensitive to changes in the price of alcohol products. Pricing policies therefore can be used to influence demand and reduce underage drinking, heavy drinking, and binge drinking. Consumer preferences and choice, per capita income variations, alternative sources of alcohol in the country or in neighboring countries, the presence or absence of other alcohol control policy measures, as well as opposition of industry groups, may influence the effectiveness of this policy measure. To help realize the benefits of alcohol tax policies, strengthened tax administration, including control of illicit tobacco and alcohol trade, plays a critical role.

Health impact of alcohol taxation

A recent study provided evidence on the comparative cost-effectiveness of alcohol control strategies. The results of the study showed that increasing alcohol excise taxes by 50% is the most cost-effective policy to reduce harmful alcohol use, as it has a low cost (< $0.10 per capita) and a highly favorable ratio of costs to effects (< $100 per healthy life year gained in both low- and high-income settings). This measure is more efficient than alternative options in the same price category. Availability and marketing restrictions are also highly cost-effective (< $100 per healthy life year gained in low-income settings and < $500 per healthy life year gained in high-income settings), while enforcement of drunk-driving laws and blood alcohol concentration limits via sobriety checkpoints had cost-effectiveness ratios in the range of International (I) $1,500–3,000 and brief psychosocial treatments were <I$150 and <I$1,500 in low- and high-income settings, respectively.

Different studies also provide evidence that increasing the price of alcohol is associated with reductions in harmful use of alcohol and alcohol-related morbidity and mortality, including liver cirrhosis deaths, violence, teenage pregnancy, and sexually transmitted diseases. There is also evidence that suggests that the benefits of higher alcohol prices also extend to the education sector, increasing the likelihood of secondary school graduation as well as post-secondary enrollment and graduation.

Another recently-published study that simulated the health and economic effects of alcohol, as well as tobacco and sugar-sweetened beverages (SSB) over 50 years for 30–79 years old populations, shows that alcohol taxation generate a health benefit of years of life gained (YLG) over 50 years of 227million and 547million for 20% and 50% price increases, respectively. It also shows that consumer expenditure increases by US$2958 billion and US$1549 billion over 50 years, and tax revenues increase by US$9428 billion and US$17778 billion for the 20% and 50% price increases, respectively.

Results from studies focusing on the State of Maryland (US) experience provide specific evidence that alcohol tax increases are an effective strategy for reducing health risks. One study showed that after the sales tax rate for alcoholic beverages increased from 6% to 9% in 2011, on top of the existing state and federal excise tax rates that are collected from manufacturers or wholesalers of alcoholic beverages which are passed on directly to the consumer in the form of raised alcohol prices, per-capita alcohol consumption and sexually transmitted diseases were reduced. Gonorrhea rates, for example, decreased 24% during the 1.5-year post-increase period. This implied that an estimated 2,400 cases of gonorrhea were prevented, saving more than US$500,000 in direct medical expenses. Another study showed that there was a significant though gradual annual reduction of 6% in the population-based rate of all alcohol-positive drivers, and a more pronounced 12% reduction for drivers aged 15–34 years following the 2011 alcohol sales tax increase. The findings suggest that young drivers tend to be alcohol price-sensitive. The sales tax increase, which has also raised about US$70 million a year for health and education programs, has proved to be an important but often neglected intervention to reduce alcohol-impaired driving.

In the case of China, modelling work has shown that for a few additional cents (US) or around 0.07 yuan per capita, a combination of anti-tobacco measures with interventions for controlling alcohol abuse, e.g., increasing tax and banning advertising, would help avert an additional 40 million DALYs lost annually.

The experience of Russia since 2010 is illustrative of the potential significant impact of raising alcohol and tobacco taxes on good health outcomes. Over the past decade, life expectancy for men in Russia increased to 65.4 years in 2016, up from 58 years in 2003, and among women it reached 76.2 years in 2016, up from 72 years in 2003. A big factor in this improvement was the effective measures adopted to control the consumption of alcohol and tobacco.

It is worthwhile looking at the European Union (EU) experience, which shows that even countries in the same economic block governed by a partially restrictive legal framework enact very different alcohol taxation policies. A recent study found only limited evidence that alcohol duties in the EU are designed to minimize public health harms by ensuring that drinks containing more alcohol are taxed at higher rates. The findings of the study indicate that only 50% of EU Member States levy any duty on wine, and several levy duties on spirits and beer at or close to the EU minimum level. Duty rates are generally higher for spirits than other beverage types and are generally lowest in Eastern Europe and highest in Finland, Sweden, Ireland, and the United Kingdom.

Public revenue impact of alcohol taxation

When assessing the fiscal impact of alcohol taxation, it is important not only to focus on the generation of public revenue but also on the expenditures required to address the social consequences of alcohol use disorders.

This consideration is of great importance, as total alcohol tax revenue collection tends to account for only a small share of the total economic cost to the government of alcohol-related harm, and even a lower share of the total economic cost of excessive drinking. For example, a CDC study showed that excessive drinking cost the United States US$249 billion in 2010, or US$2.05 per drink, a significant increase from US$223.5 billion, or $1.90 per drink, in 2006. Most of these costs were due to reduced workplace productivity, crime, and the cost of treating people for health problems caused by excessive drinking. As shown by data from another on the situation in the United States, specific excise taxes accounted for a weighted median of 20.1% of total state alcohol tax revenue, and the median total alcohol tax per drink (based on all federal and state taxes) was US$0.21, which accounted for 26.7% of the median cost to government and 10.3% of the median total economic cost of excessive drinking.

The heavy burden of alcohol-related conditions on the health system is illustrated by data from 100 emergency departments of 33 countries presented in a recent study. In most countries, alcohol’s contribution is in the realm of 20% of all presenting injuries, while alcohol’s contribution to non‐injury emergency department admissions averages 11.5%.

From a public revenue perspective, building on the experience in the Philippines with the “Sin Tax Law” adopted at the end of 2012, considerable attention has been paid in recent years to promoting alcohol and tobacco tax increases as a policy option to help mobilize additional resources to finance development priorities, particularly the expansion of universal health coverage schemes. In large measure, the experience of the Philippines over 2013-2017 is one of the most compelling examples of ambitious national alcohol and tobacco tax reform. It involved a fundamental restructuring of the country’s tobacco excise tax structure, including reduction in the number of tax tiers; indexation of tax rates to inflation; and substantial tax increases that generated more than US$5.2 billion additional revenues or 1.1% of GDP in the first 4 years of implementation, which expanded the fiscal space to increase the number of low-income families enrolled in the health insurance scheme from 5.2 million primary members in 2012 to 15.3 million in 2017.

Likewise, as part of a broad fiscal reform package approved by Colombia’s Congress on December 23, 2016, excise tax increases on alcohol and tobacco were adopted to achieve public health and revenue objectives. In addition, the fiscal reform law mandates the earmarking of these tax revenues to finance health insurance coverage and education programs at the departmental level. Similar fiscal reforms were enacted over the 2016-2019 period in countries such as Armenia, Gabon, Lesotho, Montenegro, and Nigeria, with technical support from the World Bank Group.

The “win-win” fiscal/public health nature of raising taxes on alcohol is further illustrated by the experience of other countries. In the United States, federal collections from taxes on alcoholic beverages totaled about US$11 billion in 2017. Distilled spirits are taxed at a flat rate of US$13.50 per proof gallon (a proof gallon denotes a liquid gallon that is 50 percent alcohol by volume), which translates to about 21 cents per ounce of pure alcohol. Beer is generally subject to a tax rate of US$18 per barrel, which is equivalent to about 10 cents per ounce of pure alcohol (under the assumption that the alcohol content of the beer is 4.5 percent), and the excise tax on wine that is no more than 14 percent alcohol is US$1.07 per liquid gallon, or about 6 cents per ounce of pure alcohol (assuming an alcohol content of 13 percent). As part of options for reducing the federal government deficit over 2019-2028, a Congressional Budget Office simulation showed that by increasing all taxes on alcoholic beverages to US$16 per proof gallon from current level and indexing for inflation would increase revenues by US$83 billion from 2020 through 2028, while reducing costs for society that are not reflected in the pretax price of alcoholic beverages---e.g., external costs including spending on health care that is related to alcohol consumption and covered by the public, losses in productivity stemming from alcohol consumption that are borne by entities or individuals other than the consumer, and the loss of lives and property from alcohol-related injuries and crime.

The above findings provide a strong justification for raising excise taxes on alcoholic beverages to levels where revenues match or at least cover a larger share of the economic cost of alcohol use disorders. If this is not done, the disparity that exists between alcohol-related costs to government and the collected alcohol tax revenue will be perpetuated, which is tantamount to a large taxpayer-funded subsidy of excessive drinking.

Is alcohol taxation a regressive policy measure?

A common objection to increasing alcohol excise tax is that even if it is an effective public health measure, it is poorly focused, in effect punishing all drinkers regardless of whether their drinking is problematic. As eloquently argued by Prof. Philip J Cook of Duke University, in a landmark book on the cost and benefits of alcohol control, alcohol taxation tends to be well focused on negative externalities of drinking. That is, in the case of a price increase per drink that results from raising taxes on alcohol, those who abstain (a significant proportion of most populations) would pay nothing and would be just a few extra dollars per year for light/moderate drinkers (the majority of those consuming alcohol). The bulk of the additional excise revenue would come from the top 15% of the drinkers (who average 8 or 9 drinks per day) who consume 75% of all the alcohol and consequently would pay 75% of a new tax. That is also the group that accounts for most of the alcohol-related harm, consequently yielding a well-targeted tax increase. Additionally, even if the direct effect of prices are on the consumption habits of relatively moderate drinkers, heavy drinkers can be affected indirectly. There is reliable evidence that alcohol consumers across the spectrum influence each other. So, if alcohol prices affect the drinking patterns at the median, then the upper tail of the distribution will shift inward - in other words, a reduced prevalence of heavy drinking would be expected.

Seizing the COVID-19 crisis to reduce public health risks and mobilize public funding

The COVID-19 pandemic has impacted countries with an unprecedented double shock, public health and economic, that is constraining the fiscal capacity of countries in the short- and medium-term. As argued in a previous post, pro-health taxes, including excise tax increases on tobacco, alcohol, and sugar-sweetened beverages, are a potential tool to help alleviate the ongoing health crisis and contribute to recovery. While this fiscal measure can help reduce health risks associated with the onset of non-communicable diseases and injuries and their financial and economic impacts, it can also help mobilize public revenue to expand fiscal space for health and other essential programs that benefit the entire population of countries. Indeed, projections presented in a World Bank Group report for the G-20 meeting in Osaka, Japan in 2019 showed that the substantial universal health coverage financing gap in low- and lower-middle-income countries (now exacerbated by COVID-19), can be attenuated by excise tax increases on tobacco, alcohol, and sugar-sweetened beverages. These pro-health taxes can help further mobilize public revenue while mitigating the affordability of these products by regularly adjusting the excise tax and sale tax increases in accordance with inflation and per capita income growth.

It should be clear, however, that thus far governments have failed to take advantage of taxation as a cost-effective and cost-saving method of alcohol control, despite the evidence that it could help generate significant public revenue to keep down taxes elsewhere. In some measure this outcome is due to the influence of powerful interest groups—from the alcohol industry to owners of bars and restaurants, as well as doubts about the harms of alcohol among the general public as alcohol use is associated with deep-rooted and well-accepted social and cultural norms and traditions. Dealing with this reality, active community engagement, as exemplified by the work of organizations such as Mothers Against Drunk Driving (MADD), could be galvanized to lobby for the adoption of tax increases and other measures to moderate alcohol abuse and prevent ruining the lives of alcohol-dependent people and their loved ones, as well as of those people impacted or killed as a result of alcohol-impaired driving or acts of violence.

As we move forward containing and mitigating the impact of the COVID-19 pandemic, the most significant global public health crisis of the past 100 years, we need to be clear that disease and injury prevention is not only a public health goal, but more importantly, a broad social goal that should matter to all of us since it is a key requirement for building healthy, resilient, and productive societies. Measures such as alcohol taxation, as shown by the evidence presented above, can contribute to this end by helping reduce the short- and long-term public health and economic harms caused by destructive drinking.

Source of image: "Colorful drawing: father drinking alcohol and crying child", Stock photo ID:507843974.